See This Report about Payday Check Loans

Wiki Article

New Direct Loans - Questions

Table of ContentsNot known Factual Statements About Check Cash Payday Loans The Greatest Guide To Payday Check LoansThe Best Strategy To Use For Payday Check LoansHow Payday Check Loans can Save You Time, Stress, and Money.

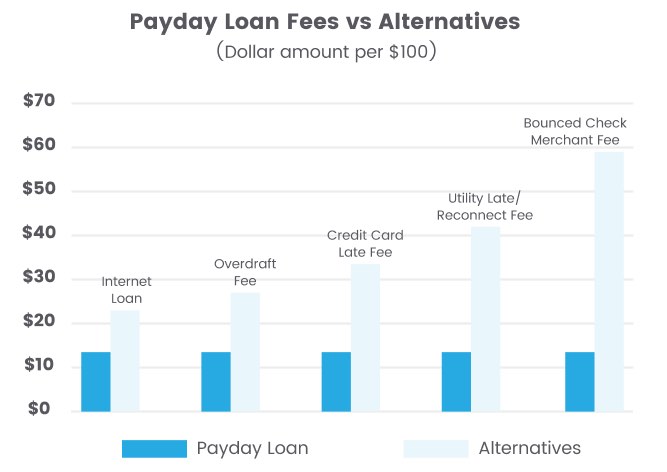

A $15 cost on a $100 funding might not sound like much - https://is.gd/uqsD7e. Payday financings are one of the most expensive resources of customer credit scores.

17% since February 2022. For a 24-month individual car loan, the typical APR was 9. 41%, according to the Federal Get. Pro Suggestion Cash advance car loans are prohibited or seriously limited in 18 states and the Area of Columbia, according to The Pew Charitable Depends On. Various other states have differing degrees of safeguards.

She goes to a storefront cash advance lending institution and applies for a $300 finance this month while she figures out exactly how to resolve her monthly shortfall. To borrow $300, Amy has to pay a $45 finance charge.

Our New Payday Loans Diaries

When the lending comes due, Amy does not have $345. She pays a $45 cost to roll over the financing.Numerous economic institutions will also charge you a fee. At the extremely least, you can quit the lending institution from taking cash you require for fundamentals, like lease or food. Note that when you get online payday advance loan, it's frequently challenging to tell if you're using with an actual loan provider or a lead generator that sends your information to lenders.

Some states call for lenders to offer consumers a repayment plan without billing added fees. In other states, loan providers need to permit struggling borrowers to enter a layaway plan, however they're permitted to tack on added charges. No matter of your state's legislation, it frequents a lending institution's rate of interest to function with you.

One more alternative is to inform the lending institution you're so overwhelmed by bills that you're thinking about personal bankruptcy. Numerous lending institutions are prepared to endanger in this situation because they understand it's most likely they wouldn't obtain anything in personal bankruptcy court.

Not known Facts About Check Cash Payday Loans

Also though cash advance lenders call this fee Get the facts a fee, it has a 391% APR (Yearly Portion Price) on a two-week funding. When the lender makes the funding he should inform you in creating just how much he is charging for the finance and the APR or rate of interest price on the loan.You can just have one cash advance financing at a time. That financing has to be paid in complete prior to you can takeout an additional. When the lending institution makes the financing he will certainly have to put your information into an information base used only by various other cash advance loan providers and the state agency that sees over them.

If you still owe on a payday advance loan and also most likely to an additional lending institution, that lending institution will certainly examine the information base and by law must reject you the car loan. Once you repay your payday advance loan, you can get a new one the following company day. After you obtain 7 payday advance loans straight, you will need to wait two days prior to you can takeout a brand-new car loan.

They can't also inform you that you can be apprehended or put in jail. If your check does not clear, then your financial institution will bill you for "bouncing" a check, and also the lender can bring you to Civil Court to accumulate the cash you owe. Naturally, if a payday lending institution transfers the check, it can trigger other checks you have created to jump.

How Fast Payday Loans can Save You Time, Stress, and Money.

Box to you. They may likewise approve your energy bill settlements without charging a fee. Yes, and also most of them do. With routine checkcashing, the business does not "hold" the check before paying it, but cashes it immediately for a charge. They might cash your own individual check or a check made out to you by another person.

If you want to pay a preprinted income or government check for $150 or less, after that they can charge you $3. 00, as well as if the check is for more than $150, then they'll bill you 2% of its value.

Report this wiki page